What is Self-Employed Person Income Relief Scheme (SIRS)?

Self-Employed Person Income Relief Scheme (SIRS) is introduced by Singapore’s Ministry of Manpower (MOM) to help self-employed individuals amid the economic crisis due to the COVID-19 pandemic. Eligible individuals will receive 3 quarterly cash payouts of S$3000 each quarter in May, July and October 2020.

SIRS will benefit self-employed individuals from diverse industries ranging from hawkers, taxi drivers, freelancers, real estate agents to sports coaches. A self-employed is usually registered as a sole proprietorship or partner in a partnership.

[Updated] The application process and required documents have been updated.

How to apply for Self-Employed Person Income Relief Scheme (SIRS)?

Singaporeans are eligible for SIRS if you meet the following SIRS eligibility criteria:

- Started work as a self-employed on or before 25 March 2020

- Self-employed person who earn no more than $2300 per month from employment work may also qualify

- Earn a Net Trade Income of no more than $100,000

- Live in a property with an annual value of no more than $21,000

- Do not own two or more properties

For married Singaporean self-employed, the following additional criteria apply:

- The individual and spouse together do not own two or more properties

- The Assessable Income of his/her spouse does not exceed $70,000.

No application is needed for SIRS if you fulfill the following criteria:

- You fulfill all the eligibility criteria.

- You are self-employed and you are already receiving Workfare payout annually. About 50,000 self-employed belong to this category.

- You are a Singaporean, aged 37 and above in 2020, and you have declared positive self-employed income for YA2019 (the work year 2018) to IRAS or CPF Board. You will be automatically notified via letter and SMS.

Fret not if you do not. Other eligible self-employed individuals may also apply for SIRS from 27 April 2020 onward if:

- Meet all the eligibility criteria and are aged 37 and above as at 31 Dec 2020 but did not declare Net Trade Income for work year 2018 or

- Meet all the eligibility criteria but are aged between 21 to 36 as at 31 Dec 2020.

If you narrowly miss one of the eligibility criteria and are facing financial difficulties, you may also submit an application for consideration.

Step-by-step Application Guide for Self-Employed Person Income Relief Scheme (SIRS)

- If you are self-employed before 1 Jan 2020, prepare the following documents:

- Proof of income as self-employed from Jan to Mar 2020, e.g. contracts, tax invoice or receipts issued to your customers

- If you earn less than $6000 in Net Trade Income for Work Year 2019 (YA 2020), prepare a copy of acknowledgement after submitting IRAS Form 144.

- If you earn more than $6000 in Net Trade Income for Work Year 2019 (YA 2020), prepare a copy of IRAS Notice of Assessment (NOA) or IRAS Consolidate Statement Form B.

- Proof that you are facing financial difficulties (if any), such as dependent’s medical bills, blue/orange CHAS card, etc

- If you are self-employed only from 1 Jan 2020 but on/before 25 Mar 2020, prepare the following documents:

- Proof of income as self-employed from Jan to Mar 2020, e.g. contracts, tax invoice or receipts issued to your customers

- Proof that you are facing financial difficulties (if any)

- In addition to the above, if you are married, prepare the following documents:

- Your spouse’s IRAS Notice of Assessment / Consolidated Statement Form B / Consolidated Statement Form B1 for Work Year 2019 (YA 2020)

- Income documents for Jan – Mar 2020, e.g. payslip, contract of service etc.

- Get your SingPass login ready.

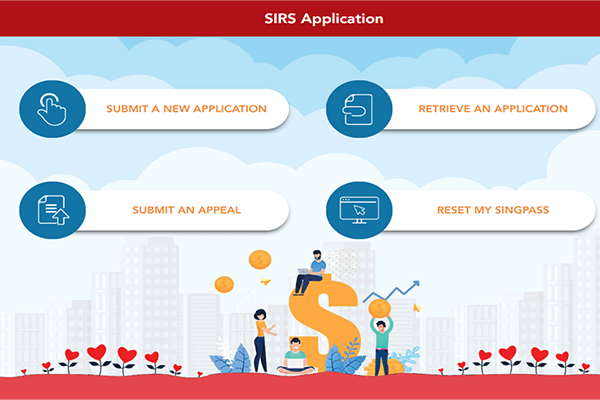

- Go to this link. This online application link will only be available from 9am to 10pm daily.

- Tick the eligibility checker, click on next. If you are qualified, click on Apply Now.

- You will be directed to the application on another pop-up page. Click on Click Here to Proceed.

- Click on Submit A New Application.

- Enter your personal info and login with your SingPass.

- Fill in the necessary information, upload your documents and submit.

What happens after the application

Your payout amount may be less than $3000 per quarter if you do not meet all the eligibility criteria but face valid and extenuating or forgivable circumstances. Your application may still be approved but the payout quantum will be moderated accordingly.

If your application is approved, NTUC will forward a digital declaration form for you via text message in June and September to complete and return before the next payout tranche. This is to confirm your continued eligibility for SIRS.

How to appeal for Self-Employed Person Income Relief Scheme (SIRS)?

This article will be updated once more information on appeal is released by MOM or The National Trades Union Congress (NTUC).

FAQ

I am eligible for SIRS but applied late after May. Will I miss the payouts in May/Jul/Oct?

As long as you are eligible, you will get all the 3 payouts progressively.

I do not meet the criteria now. Can I apply when my circumstances change later?

Yes. You can apply but you may not be entitled to all 3 payouts.

Have you also checked whether you are qualified for one of the following?

How to qualify and apply for Temporary Relief Fund (TRF) Scheme