Why is the interest rate increasing in Singapore?

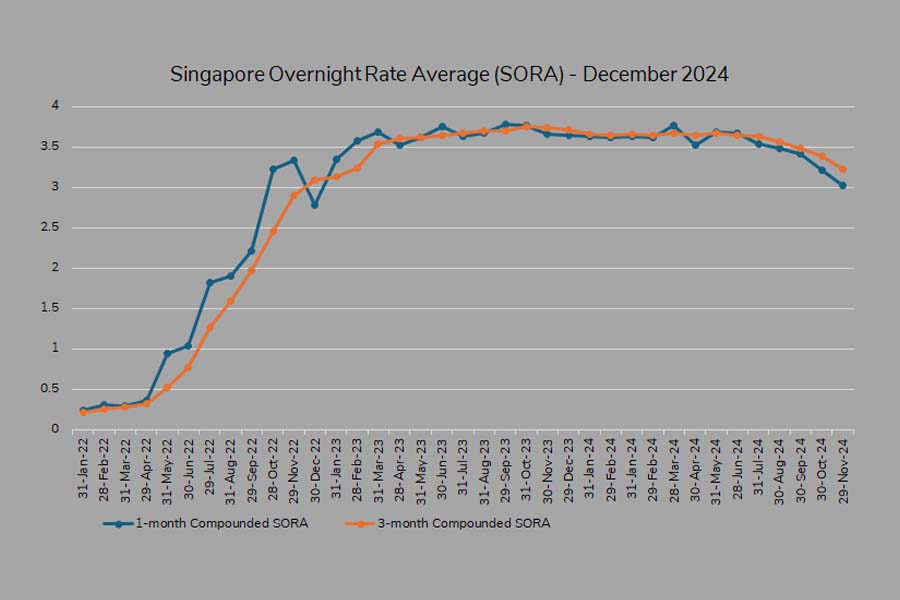

Interest rates in Singapore and globally have risen dramatically since mid-2022. To illustrate the extent of this increase, please refer to the SORA table below.

| Value date | 1-month Compounded SORA | 3-month Compounded SORA |

| 31 Jan 2022 | 0.2328 | 0.2065 |

| 28 Feb 2022 | 0.3101 | 0.2504 |

| 31 Mar 2022 | 0.2949 | 0.2760 |

| 29 Apr 2022 | 0.3588 | 0.3227 |

| 31 May 2022 | 0.9443 | 0.5263 |

| 30 Jun 2022 | 1.0316 | 0.7720 |

| 29 Jul 2022 | 1.8263 | 1.2712 |

| 31 Aug 2022 | 1.9078 | 1.5967 |

| 29 Sep 2022 | 2.2091 | 1.9732 |

| 28 Oct 2022 | 3.2311 | 2.4534 |

| 29 Nov 2022 | 3.3295 | 2.9007 |

| 30 Dec 2022 | 2.7776 | 3.0966 |

| 31 Jan 2023 | 3.3496 | 3.1307 |

| 28 Feb 2023 | 3.5828 | 3.2352 |

| 31 Mar 2023 | 3.6828 | 3.5420 |

| 28 Apr 2023 | 3.5265 | 3.6047 |

| 31 May 2023 | 3.6175 | 3.6211 |

| 30 Jun 2023 | 3.7528 | 3.6414 |

| 31 Jul 2023 | 3.6375 | 3.6774 |

| 31 Aug 2023 | 3.6693 | 3.6949 |

| 29 Sep 2023 | 3.7762 | 3.7052 |

| 31 Oct 2023 | 3.7719 | 3.7512 |

| 30 Nov 2023 | 3.6626 | 3.7464 |

| 29 Dec 2023 | 3.6511 | 3.7090 |

| 31 Jan 2024 | 3.6270 | 3.6571 |

| 29 Feb 2024 | 3.6207 | 3.6466 |

| 31 Jan 2024 | 3.6270 | 3.6571 |

| 29 Feb 2024 | 3.6207 | 3.6466 |

| 28 Mar 2024 | 3.7621 | 3.6762 |

| 30 Apr 2024 | 3.5296 | 3.6465 |

| 31 May 2024 | 3.6866 | 3.6678 |

| 28 Jun 2024 | 3.6669 | 3.6428 |

| 31 Jul 2024 | 3.5343 | 3.6389 |

| 30 Aug 2024 | 3.4790 | 3.5690 |

| 30 Sep 2024 | 3.4213 | 3.4882 |

| 30 Oct 2024 | 3.2163 | 3.3834 |

| 29 Nov 2024 | 3.0218 | 3.2322 |

Currently, most home loans and mortgages are linked to 1-month or 3-month compounded SORA, which will replace SIBOR following its discontinuation from 1 January 2025.

As the U.S. Federal Reserve (Fed) raises interest rates to combat inflation and address the rising cost of living, other countries, including Singapore, are inevitably impacted. Since Q2 2022, SORA rates in Singapore have been climbing rapidly.

Consequently, homebuyers will face higher interest rates on property loans, and businesses with SORA-based loan products will also feel the effects.

On a positive note, rising interest rates also lead to increased savings account and fixed deposit interest rates. Major banks are actively competing to attract individuals with surplus cash to place fixed deposits (FD), bolstering their SGD holdings.

A fixed deposit, also known as a time deposit or term deposit, is a savings account where customers commit to depositing a specific sum of money with a bank for a predetermined period. During this time, withdrawals are typically not allowed, or penalties may apply based on the bank’s terms.

Since banks introduced attractive FD promotions, many Singaporeans and residents have been queuing to make their spare cash work harder. In 2022, rates surpassed 4% per annum, marking the highest levels seen in 24 years! However, in September 2024, the Fed lowered interest rates for the first time in over four years, leading to expectations that fixed deposit interest rates in Singapore may decrease in the coming months.

If you have spare cash, consider the current rates below to take advantage of the situation. Additionally, we have included some important factors to consider before placing a fixed deposit at the end of this page to help you understand the associated risks. Remember, fixed deposits are not entirely risk-free.

List of SGD fixed deposit interest rates in Singapore (December 2024)

Below are the latest interest rates for Singapore Dollar (SGD) fixed deposits offered by major banks and financial institutions in Singapore. To allow apples-to-apples comparisons, we have compiled a list of 12-month fixed deposit tenure placed physically at the counter for all SDIC-insured banks (as of 14 December 2024):

| 12-month Fixed Deposit (SGD) | % per annum | Min. Deposit | Renew | Notes |

| RHB | 2.9 | 20,000 | – | 3% p.a for premier banking. Same rates for 3-month, 6-month & 18-month tenures. |

| HL Bank | 2.68 | 100,000 | – | 3.2% p.a for 3-month & 6-month tenures with minimum $100k placement. |

| Singapura Finance | 2.65 | 20,000 | No | 2.65% p.a for 8-month and 2.6% p.a for 15-month tenures. |

| ICICI | 2.5 | 5,000 | – | 2.7% p.a for 6-month tenure, 2.6% p.a for 9-month and 2.5% p.a for 3-month tenures. |

| BOC | 2.5 | 10,000 | – | 2.6% p.a via mobile banking (min = 500) & must be new placement. |

| DBS / POSB | 2.45 | 1,000 | – | Rate for first $19999 only. 0.05% from $20000 onwards. |

| ICBC | 2.25 | 20,000 | – | For deposits over the counter from S$200k onwards, earn 2.45% p.a. for a 12-month tenure. For deposits via e-bank, earn 2.3% p.a for placements from S$500 to less than S$200k & 2.45% p.a from S$200k onwards. Other tenures of varying rates from 2.35% – 3% p.a. |

| HSBC | 2.15 | 30,000 | – | 2.45% p.a. for 3-month & 2.35% p.a. for 6-month FDs between S$30k and < S$200k. For deposits of >= S$200k, 2.65% p.a for 3-month, 2.6% p.a for 6-month & 2.45% for 12-month tenures. |

| OCBC | 2.1 | 30,000 | – | 2.25% p.a for 6-month tenure over the counter. For placements online, 2.45% p.a for 6-month tenure and 2.3% p.a for 12-month tenure. |

Notes:

- Maybank offers an interest rate of 2.8% p.a. for 6-month fixed deposits with a minimum placement of S$20,000, available for deposits made online through the iSAVvy Savings Account. For those who bundle their deposits with a cash deposits into their savings account, the bank provides an interest rate of 3.15% p.a. Lower interest rates ranging from 2.5% to 2.9% per annum are also available for 9-month and 12-month tenures. As of 27 September 2024, the bank has discontinued fixed deposit using CPF funds.

- CCB offers 2.8% p.a for 1-month, 2.7% p.a for 2-month, 2.6% p.a. for 3-month, and 2.5% p.a for 6-month FD with minimum placement of S$1,000,000. The bank no longer offers 12-month tenure as of 20 August 2024.

- CIMB offers 2.75% per annum interest rate for 3-month SGD Fixed Deposits with a minimum deposit of S$10,000. Preferred banking customers enjoy rate of 2.8% per annum. Other tenure options including 6-month, 9-month and 12-month FDs are available at varying rates between 2.55 – 2.8% per annum. However, this is an online promotion in which the placement has to be made online.

- Hong Leong Finance offers an interest rate of 2.65% p.a for online placements from S$50,000, 2.6% p.a for online placements between S$20,000 & S$49,999.99, and 2.55% p.a for placements between S$5,000 and S$19,999.99 with an 10-month tenure. The finance company also provides varying rates of 2.6% to 2.75% for shorter tenures of 6-month and 8-month. For counter placements, rates range from 2.55% to 2.7% p.a. for 6-month, 8-month and 10-month tenures, with a minimum placement of S$20,000. The company no longer offers a 12-month tenure as of 27 September 2024.

- Standard Chartered Bank (SCB) offers 2.55% per annum interest rate for 6-month SGD Fixed Deposit with a minimum deposit of S$25,000. Priority banking and priority private banking customers enjoy preferential rate of 2.65% and 2.75% per annum, respectively. The bank no longer offers any promotional rate for 12-month FD tenure as of 5 January 2023.

- UOB offers 2.5% per annum for a 6-month SGD fixed deposit and 2.3% per annum for a 10-month tenure with a minimum placement of S$10,000. The bank no longer offers a 12-month tenure as of 5 March 2024.

- Citibank offers 2.4% per annum interest rate for a 3-month or 6-month fixed deposit between S$50,000 and S$3,000,000. The offer is only open to Citigold and Citigold Private Client. The bank no longer offers any promotional rates for 12-month FD tenure as of 6 January 2023.

- While some banks explicitly mentioned that deposits have to be made from fresh funds, some did not. From our ground checks, it is safe to assume that all banks require deposits to be made from fresh funds, unless otherwise stated. Fresh funds means the money for the fixed deposit cannot be transferred from within the same bank or institution.

- Premature termination fee may apply, depending on the terms of each bank.

What are Singapore Deposit Insurance Corporation (SDIC) insured deposits?

The SDIC is a company limited by guarantee set up by the Monetary Authority of Singapore (MAS) to administer an insurance scheme that protects monies placed by individuals and non-bank depositors with banks and financial institutions in Singapore. The insurance covers SGD-denominated deposits only, and up to SGD 100,000 placed with members of the scheme.

In the event that a financial institution or bank collapses, the insurance will compensate the first SGD 100,000 of each depositor’s monies. This applies not only to savings deposits but also to fixed deposits, CPF, and SRS schemes. If a depositor has multiple accounts or deposits with the troubled bank, all accounts will be aggregated and covered up to SGD 100,000 only.

If you are planning to place a fixed deposit, you will need to consider the risk of a bank failing that will make you lose all your monies. To mitigate this risk, though how unlikely it may be, you can split your deposit across different banks up to a maximum of SGD 100,000 each.

Should I place a foreign currency fixed deposit that is offering higher interest rates?

As you go through the fixed deposit interest rates offered by various banks and institutions, you may notice that some foreign currency fixed deposits are offering higher interest rates ranging from 3% to 10%. While you may be tempted to put your money there to earn the higher interest, there are substantial foreign exchange risks involved with this option.

For example, if you intend to place a 12-month CNY-denominated fixed deposit today, you will first need to convert your SGD to CNY. Similarly, when your FD matures in 12 months, you will then need to convert it back to SGD at the prevailing rate. In the event that CNY depreciates against SGD over the year, you will make a foreign exchange loss. The loss may even be more than the interest rate you earn from the FD, depending on how much it depreciates.

Also, it is useful to note that foreign currency denominated deposits are not covered by SDIC insurance. In the event that a insured bank fails, you will lose your principal even if it is a member of the scheme. If you are risk averse and are not prepared to make any losses, foreign currency FD is not suitable for you.